Intrinsic Value Calculator OE 9.2

Free Version

Publisher Description

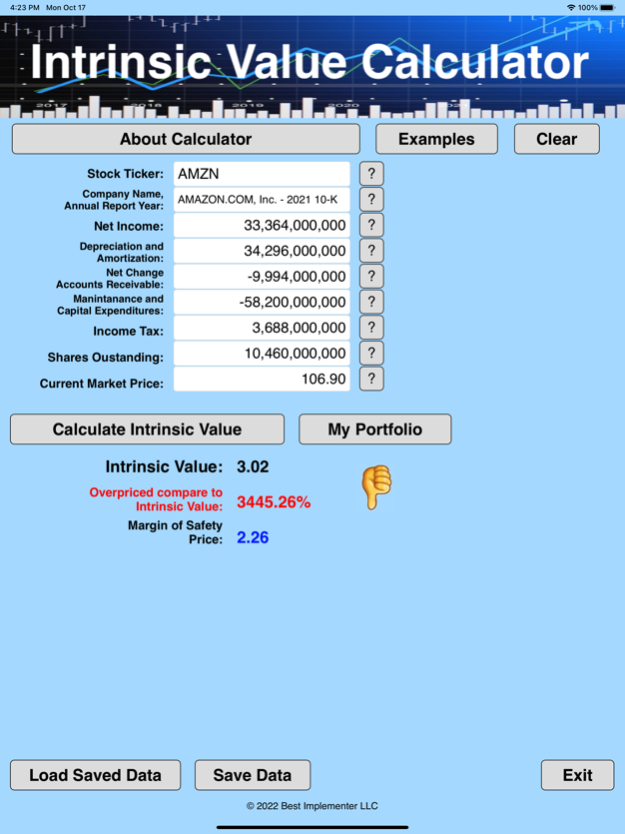

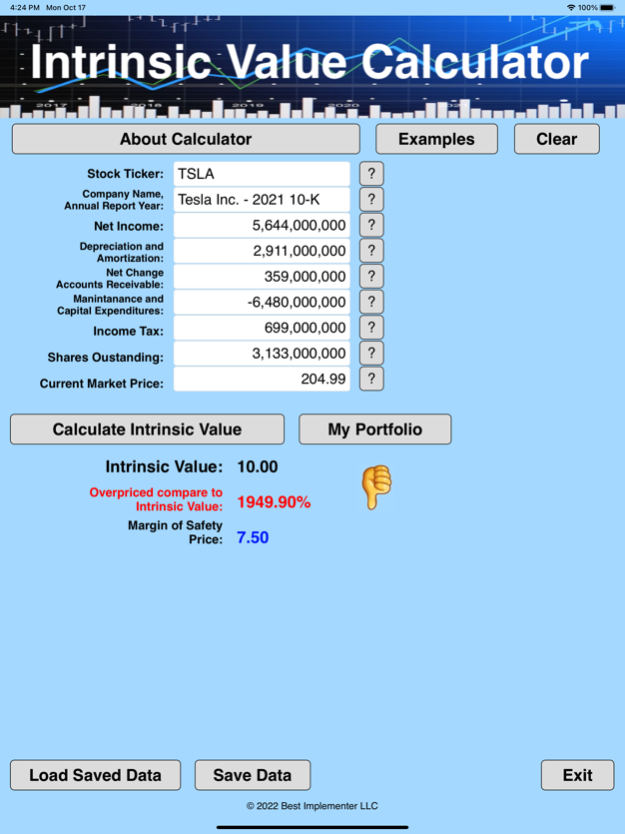

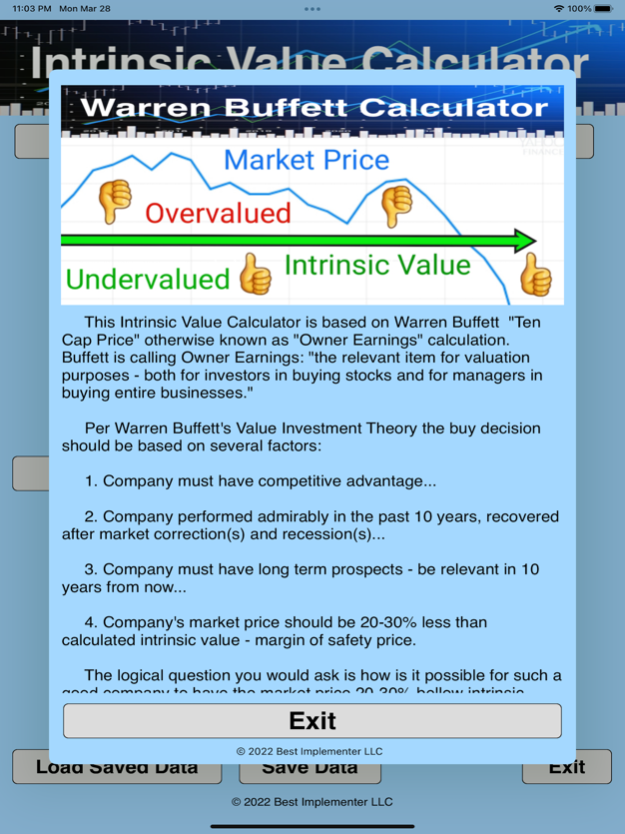

This Intrinsic Value Calculator is based on Warren Buffett's "Ten Cap Price" otherwise known as "Owner Earnings" calculation. Buffett is calling Owner Earnings: "the relevant item for valuation purposes - both for investors in buying stocks and for managers in buying entire businesses."

There are many different ways to calculate Intrinsic Value. For example based on DCF (Discounted Cash Flow) Model or EPS (Earnings Per Share). Our new "Intrinsic Value Calculator DCF" and "Intrinsic Value Calculator EPS” applications are also available on App Store.

Per Warren Buffett Value Investment Theory the buy decision should be based on several factors:

1. Company must have competitive advantage...

2. Company performed admirably in the past 10 years, recovered after market correction(s) and recession(s)...

3. Company must have long term prospects - be relevant in 10 years from now...

4. Company's market price should be 20-30% less than calculated intrinsic value - margin of safety price.

The logical question you would ask is how is it possible for such a good company to have the market price 20-30% bellow intrinsic value? The answer is: YES it's possible. The potential reasons could include: bad news about the company, company's industry is out of market favor, market is in correction or recession.

This proves that current stock Market Bubble is bigger than "DOT-COM Bubble" of 2001 or "Housing Bubble" of 2008. It's just a matter of time before it will POP presenting an opportunity for Value Investors to buy their favorite stocks for less than intrinsic value! But in order to buy your favorite stocks for less than intrinsic value you need to know what this intrinsic value is. This is when our Intrinsic Value Calculator comes handy. You can calculate, store, reload and compare intrinsic value with market price anywhere and anytime, and all you need is your phone and our application.

The goal of this application is to help value investors with calculation of intrinsic value. Most of the values required for calculation could be found on company's latest annual report. Annual reports can be found on company's website in investor relations section. Values missing in annual report could be found on GOOGLE.

Our calculator comes with 11 Examples: Tesla, Bank of America, JPMorgan Chase, Alibaba, Baidu, Microsoft and all FAANG stocks: Facebook/Meta, Apple, Amazon, Netflix and Alphabet’s Google.

This calculator doesn’t take growth into account. In case if you want to calculate Intrinsic Value based on growth, you can try our new "Intrinsic Value Calculator DCF" and "Intrinsic Value Calculator EPS" applications are also available on App Store.

There are 2 Subscription options available: Monthly and Annual. Each Subscription comes with 1 MONTH FREE TRIAL. Each SUBSCRIPTION option provides FULL ACCESS to ALL FEATURES of calculator. Payment will be charged to iTunes Account after completion of 1 month free trial period. Account will be charged for renewal within 24-hours prior to the end of the current period. Subscriptions can be managed by the user and auto-renewal may be turned off by going to the user's Account Settings after the purchase.

Terms of Use (EULA):

https://www.apple.com/legal/internet-services/itunes/dev/stdeula/

Privacy policy:

http://bestimplementer.com/intrinsic-value-calculator.html

© 2024 Best Implementer LLC

Feb 21, 2024

Version 9.2

Someone would argue that Nvidia is a growth company and have to be calculated based on growth formulas, so we calculated it based on DCF and EPS formulas.

Based on DCF formula intrinsic value of NVIDIA is $93.10 overvalued compare to market price by 675% !!!

Based on EPS formula intrinsic value of NVIDIA is $79.14 overvalued compare to market price by 811% !!!

Our Intrinsic Value Calculator EPS and DCF applications also available on App Store.

About Intrinsic Value Calculator OE

Intrinsic Value Calculator OE is a free app for iOS published in the Accounting & Finance list of apps, part of Business.

The company that develops Intrinsic Value Calculator OE is Best Implementer LLC. The latest version released by its developer is 9.2.

To install Intrinsic Value Calculator OE on your iOS device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2024-02-21 and was downloaded 1 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the Intrinsic Value Calculator OE as malware if the download link is broken.

How to install Intrinsic Value Calculator OE on your iOS device:

- Click on the Continue To App button on our website. This will redirect you to the App Store.

- Once the Intrinsic Value Calculator OE is shown in the iTunes listing of your iOS device, you can start its download and installation. Tap on the GET button to the right of the app to start downloading it.

- If you are not logged-in the iOS appstore app, you'll be prompted for your your Apple ID and/or password.

- After Intrinsic Value Calculator OE is downloaded, you'll see an INSTALL button to the right. Tap on it to start the actual installation of the iOS app.

- Once installation is finished you can tap on the OPEN button to start it. Its icon will also be added to your device home screen.